Over 20 Years + Experience in Stock Market Teaching

Get latest updates in Stock Market news and special offers in your inbox.

MARKET MANTRA

ADVANCE MARKET MANTRA

INTRADAY PROFIT STRATEGIES

STOCK MARKET TECHNICAL ANALYST

ADVANCE STOCK MARKET TECHNICAL ANALYST

SUCCESSFUL BOLT OPERATOR

Order Online Courses, E-Books, Paper Back Physical Books & more.

“ Share Market Courses and Training in Mumbai ”.

We are conducting courses from 11+ years and our teaching skills of share market are gain by students worldwide in which they have gain maximum benefits and profits.

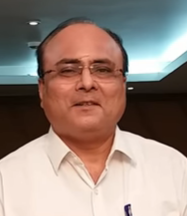

India’s #1 trainer of stock market training and the founder of Dhanashri Academy. Nimish Sir’s Dhanashri Academy aims at offering the perfect content and guidance to help you master the art of money making from Stock Market. For over a decade, Nimish Sir’s experience & expertise in the Stock Market has helped millions of Indians, to earn and fulfill their long cherish dreams to become independent and RICH.

-

STUDENTS TRAINED

Students Trained across the world55000+

-

ACTIVE COURSE

All types of expert courses available20+

-

YEARS OF EXPERIENCE

Years of Share Market Training Expertise25+

-

SEMINARS HELD

Seminar held across India2100+

25 YEARS OF EXPERIENCE

Since past 25+ YEARS we are conducting courses and all our students have gained all necessary skills to gain maximum benefits and profits irrespective of market positions.

TRADING WHAT,

WHEN AND HOW?

We help 360 degrees with complete process of identifying potential trade, riding the trade, entering into trade and looking profits at the end of that trend with well-built management system with risk and money.

WE CATER TO ALL

If you are a first time investor, a seasoned pro, an “in and out” day trader or a long term investor, Our systems and processes will help you with the right information needed for success in today’s market.

Amruta

It�s really overwhelming, the way this course is designed which gave me really good knowledge and information of Stock Market with this course. And this is my firm opinion.

Wasim Sheikh

After experiencing other similar trading courses, I can undoubtedly say that this Course gives a lot of information. Its top-notch course and personal guidance with highly qualified Nimish Sir to give the training.

Bhagyashree

I am able to trade very profitably myself since i have completed the course. I highly recommend you to buy this online course as its available at such a low cost and I learned everything by sitting at home and handling the family. Its Really Easy.

SUNIL KUMAR SINGH

In reality we had a phobia from share market but when I came here simple people like us learned about earning money from share market and also got to know about retirement plan, portfolio and learned how to easily earn money from share market. So I thank Nimish Sir and Dhanashri Academy for that.

TEJISHRI

I learned a lot today by attending this session, I have achieved confidence to invest in share market. I used to believe investing in share market is a game and by attending this session I have gained the knowledge for the same. So I thank Nimish Sir and Dhanashri Academy to making me learn this beautiful course.

SUHAS KODNEKAR

By doing the trading course today I learned about new techniques, I think if I trade in regular basis I can come at top 5% traders and I got to know, in day to day life how I can attract money which I didn�t knew at age of 30 to 36. I got to know by just attending Nimish Sir�s online course, so I would like to thank Nimish Sir Dhanashri Academy.

MAHESH SHAH

I have been investing in share market since last two years but never had an idea about so many things which were thought today and gained a lot of knowledge specifically how to select the IPO and intraday trading which I haven�t been doing. I sincerely thank Nimish Sir and Dhanashri Academy and making me gain confidence in share market again.

SITISH THAKUR

By doing the Market Mantra Course I have earned a lot of information and I have full confidence that I can change me and my family�s financial conditions. And I have the courage to contribute to my country and to my community. So I thank Nimish Sir and Dhanashri Academy.

RAKESH VYAS

Before attentding this online session whatever myths I had about share market are all cleared the way Nimish Sir thought me how to deal in share market, How to use different tricks and keys was excellent and ways to attract money was amazing and it was a wonderful experience. So thank you Nimish Sir and Dhanashri Academy.

SACHIN LABDE

Thankyou Nimish Sir for this online session. I earned enough amount of money but from that money how I can invest in the right place and grow is why I attended this online Course from throughout the day how much knowledge I received in near future. I sure am going to implement it and grow my wealth as Nimish Sir took a very deep subject and presented it to us very easily.

RAJESH PANCHAL

I don�t have a lot of knowledge about share market but I came here by seeing the hype of intraday and got to learn so much about it for that I would like to thank Nimish Sir. I got a lot of knowledge about stoploss scientific strategies which is not only going to help me but also the people who attended the session today.

AMITA DESAI

I attended seminar and I am doing the online course right now so first I thank Nimish Sir and his simple nature who wants only the best for their students and want them to become millionaires. He gives the best knowledge about market strategies which really deserves a complement. Different types of trading strategies, money and portfolio management in a very short period of time.

NIRMAL SHAH

I am a C.A. student and from a long time I have been looking forward for the field of stock market and have been tracking it since 8th grade. Today by taking and attending the online course, I have found a right path to put my focus into. Thank you Nimish Sir.

MINA RAMAKHADI

I work as a graphic designer for 20 years but I had problems to handle my money but today when I attended this seminar today I didn�t knew how to invest in share market but now I have positive view towards investing in share market and I believe my problems will be over. And I want to tell everyone to attend the seminar and thank Nimish Sir.